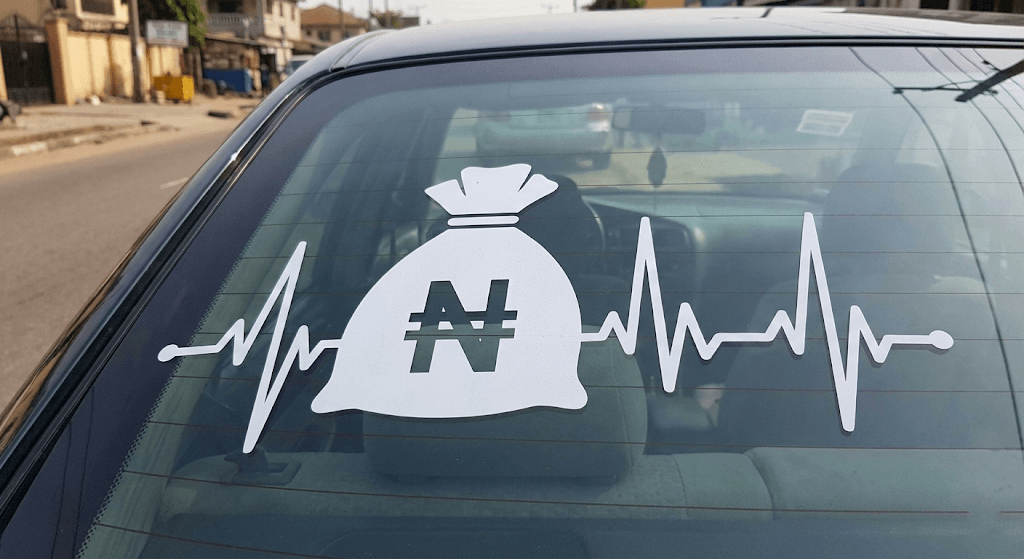

The Surprising Ways Your Health Habits Can Safeguard Your Wealth and Vice Versa

We’ve all heard the saying: “Health is wealth.” Nothing has ever been truer. They say a man who is healthy has 99 problems, but a sick man only has one. That’s because when you are sick, every other problem seems pale in comparison. Wealth becomes meaningless if you don’t have the strength or peace of mind to enjoy it.

When we are young, we take our body and mind for granted. We act like we are invincible, like health problems live in the distant future. So we try to delay taking care of our bodies until the unexpected happens. And when it does, it’s not just your body that takes the blow. Your wallet does too. And if your wallet isn’t ready? Debt comes knocking.

Are you using your money to protect your health, and your health to protect your money?

A Two-Way Street

Health Protects Wealth

Good health protects your wealth in a way that can’t possibly be measured. How do you put a price on healthy habits like exercise, eating well, and avoiding smoking— the very things that prevent heart disease, diabetes, stroke, or cancer?

If you ignore these habits, you risk being blindsided by a critical illness that drains not just your strength but your savings. Not only is prevention better than cure, it is also cheaper than cure. Cheaper for your pocket, and cheaper for your peace of mind.

Let’s look into the ways that health protects wealth:

Nutrition

This is the first line of defense that a person has against poor health. The quantity of your food should always be in moderation, especially for things like sugar, fat, and alcohol.

The quality of your food should also not be overlooked. It is very tempting to eat out every time or buy a lot of junk or processed food. Eat meals that your great-grandparents or even a caveman would recognize, or you risk obesity, diabetes, heart problems, kidney problem among others. Buy less processed food, cook most of your meals, and watch how much your health and wallet benefit.

Exercise

Everyone has heard this one before, but not everyone is doing it. The human body was not designed to sit all day.

Start strength training at a local gym near you; get your reps in. If you can not afford a gym, take daily or weekly walks/runs. If you can not leave the house for too long, buy a skipping rope or do body weight exercises at home. In the long run, what matters is consistency.

Sleep

Hustle culture likes to demonize sleep. They’d brag: “Let them sleep while you grind.” Or wax lyrical about how they work for 90 hours per week and only sleep 3 hours each night. That’s a gateway to illness. Sleep removes toxins from the brain, balances blood sugar, regulates hormones, and improves the immune system. Poor sleep could literally lead to diabetes, obesity, dementia, and mental illness.

Preventive Care

This is any action you take to prevent your body from deteriorating into illness in the future. It’s your annual checkups, vaccinations, scaling and polishing, blood pressure & blood sugar checks, HPV tests, pap smear, prostate and breast cancer screenings.

It’s also about listening to your body. Blood in urine, dizziness, persistent pain, swellings and lumps, wounds that refuse to heal, gradual hearing loss, fading vision; don’t ignore them. Get them checked.

Health Insurance

Buying health insurance is another very important aspect of preventative care because it shields you from the financial costs of unexpected illnesses. People tend to avoid buying health insurance because they feel it is a waste of money. They think that because they never fall sick, they are safe. But the nature of emergencies is that we never see them coming.

If you fall sick unexpectedly, health insurance may cover all or some of its costs. That protects your pockets. People think they don’t need health insurance until they need it, but by then, it’s too late. You are going to be tempted to skip it, don’t. The wrong diagnosis at the wrong time can crush you financially. Lots of 27-year-olds seem fine until they are suddenly diagnosed with a brain tumor or get into a car accident. Stay ready, so you don’t have to get ready.

If you want extra security, consider critical illness insurance coverage for more serious illnesses, such as kidney failure, cancer, heart attack, stroke, that your regular insurance may put a limit on (the maximum amount they are willing to pay).

High Risk Habits

Sometimes it’s not illness but our own habits that wreck both health and finances. A good example of this is unsafe commuting (racing, overspeeding, texting while driving, driving tired, DUI). I had a relative who got into an accident because he fell asleep behind the wheel! He broke multiple bones in his legs and had to pay for an expensive physiotherapist after he was discharged from the hospital, on top of not being able to walk for months. That was a result of sleep deprivation.

Smoking

Smoking (weed, cigarettes, vaping, hookah) is another risky habit that Nigerians tend to see as “not a big deal,” especially people who smoke weed. These are all high-risk habits that young people think will never catch up with them. You’d hear all sorts of excuses about how medicinal it is, or “I’m just chilling,” “It helps me relax,” “I don’t take it that much.” But here’s the thing, you are still ingesting foreign bodies—(smoke, nicotine, carcinogens, carbon monoxide) into your lungs that can damage your tissues, and no matter which way you slice it, that has consequences.

Other people go as far as saying they know someone who smoked all their lives into their 90s, and to that I say every human being has different sensitivities. What if your lungs are the most sensitive parts of your body, and all you have to do to get cancer is to smoke consistently for a year?

You don’t know your body or what illnesses you have a tendency to get. Cancers, especially lung cancer is the potential reward of this particular high-risk behavior. Do you know how expensive it is to treat cancer in Nigeria? As of 2023, a single chemotherapy session costs between ₦600,000 and ₦1 million. I’d play it safe rather than sorry, if I were you.

Other high-risk habits include unsafe sex, sleeping with a cheating partner, which could lead to permanent STDs, etc. HIV retroviral drugs are not cheap.

Mental Health

Poor mental health drains wealth in sneaky ways. Stress leads to binge eating, impulsive shopping, and emotional splurges. Loneliness or burnout can push you to overspend on getaways or entertainment just to “feel better.”

Instead, explore cheaper, healthier outlets: exercise, yoga, prayer, meditation, journaling. Your emotions get balanced, and your bank account stays intact.

Elder Care

In Nigeria, as well as in many parts of the world, when an elderly person falls ill, the burden lies on the adult children’s shoulders. By burden, I mean not just physical care but almost always the financial cost. A lot of parents see their children as their retirement plan, hence their favorite prayer: May we reap the fruits of our labour. That includes financial upkeep and health care in their ailing years. The best way for them to enjoy the fruit of their labor is to be healthy enough to enjoy time with their children and grandchildren

That said, it is in your best interest to encourage your parents to take good care of their health. Encourage exercise, healthy food, cut down dramatically on sugar, alcohol, and smoking. If they don’t become responsible with their health and they fall ill, the burden of care could fall on you. This could disrupt your wealth, depending on the magnitude of their illness. Consider either investing in or encouraging them to invest in health insurance. It’s almost mandatory for older people to get insurance, just to absorb the cost of unforeseen illnesses.

Wealth Protects Health

Now, let’s flip the coin. Wealth, too, acts as a powerful shield for your health. On some level, everyone knows this.

Money buys freedom, security, and access. It’s the difference between being stuck in a toxic job versus having the option to rest, heal, or even quit. It’s the difference between delayed treatment and immediate specialist care. In some cases, money literally saves lives. This is one of the best reasons to pursue wealth. Start with the right mindset, learn about savings, budgeting, inflation, investments, and financial independence.

Let’s explore some of the ways that wealth can protect your health:

- Time: Financial freedom buys you one of the most valuable assets: time. Less stressful long commutes, more time for restful sleep, exercise, travel, hobbies, and quality time with your family. When you have a huge nest egg, you can quit a stressful or even regular job when sick.

- Better care: You can afford to pay for better care, faster access to treatment, trainers, physiotherapists, in-house nurses, massage therapists, acupuncturists, psychiatrists, IVF, egg freezing, specialist hospitals, and international health care.

- Quality of life procedures: You can afford expensive quality of life procedures like LASIK, Cochlear Implant Surgery, more comprehensive checkups than insurance may allow, CPAP, scaling and polishing, braces, gastric bypass, etc

- High quality essentials: skin care, ergonomic chairs, supportive shoes, newer cars (newer models prevent accidents), good mattress.

- Maintenance: Top-notch maintenance of things that can potentially endanger you, such as your car (brake pads, oil change etc), gas cooker (replacement, testing)

- Environment: Wealth means access to safer environments with better security, cleaner air, and water.

- Nutrition: You gain a nutritional advantage because you can afford high-quality meals, especially protein consistently. You may be able to afford a cook.

All In All

Despite our best efforts, sometimes we still get sick; it is the cycle of life. If you find yourself in a situation where you are facing health issues that cost more than you can afford, do not let your first response be debt, except for emergencies, of course.

Try crowdfunding or reaching out to foundations and NGOs like Health Emergency Initiative or Project Pink Blue. They often step in to pay hospital bills, fund surgeries, organize screening, and support critical care. But to be honest, these supports are often limited; there may be way too many people waiting their turn for help. Prevention, self-reliance, and long-term good wealth-building habits should still be your first line of defense.

Every effort and habit that you put into protecting your health today is saving you thousands, if not millions, tomorrow. On the other hand, your wealth habits and pursuit of financial independence will also protect you in a way that preserves your independence and dignity.

Take care of both. Because one without the other leaves you vulnerable.

Yours Mindfully,

Adeyinka