Growing up, I was always so confused about how people got wealth. I come from a lower-middle-class background. When my family first moved to Lagos, we lived in a little face-me-I-face-you house, then to a room and parlor, then graduated from flat to flat and eventually to our first self-owned home, then second home.

I used to be so naive about how money came about and how much money my parents really had. When my dad told us kids that we would be moving to our first house, I asked him if the house would have its own swimming pool. But my parents had regular teaching jobs, so that wasn’t happening. Mind you, I was probably ten years old at this time.

As I got older, my ideas around money were always around managing it, courtesy of my mother. Never spend too much, reuse the oil, don’t waste this or that. Eventually, my understanding of money evolved, thank God! But I still didn’t understand wealth. It took a lot of self-education to get to that point. Which tells me that if I could do it, without coming from a rich background, you can too.

From what I’ve observed about Nigerians, the prevalent ideas around wealth and where it comes from include:

- Praying really hard

- Fame: being a footballer, an actress, a musician

- Luck and the belief that the rich were just lucky/evil and cheated their way to the top

- Gambling: Lotto: Baba Ijebu, Naira Bet, Betnaija

- Paying tithes in church/Mosque so that God can pay you back in multiple folds

- Politics (by chopping government money)

- Crime: Scams, Yahoo Yahoo & 419

- Marrying rich/being a mistress to a politician

- Traveling abroad, aka Japa

- Money Rituals (Nollywood, thanks for nothing)

- The fruits of your labors (aka children paying black tax)

- And my personal favorite, a helper that will randomly see you one day and help with money or a huge breakthrough like a high-paying job.

I hate to burst your bubble, but none of the above ways are practical ways to attain wealth. Why? You might say: “But I’ve seen people get rich from doing so-so and so.” I’m not saying it is impossible to get money from any of these methods. Lots of people get money from being a famous footballer or actress, and maybe you have even seen that brother on your street who is rumored to be a Yahoo boy now rolling in his own Mercedes. Or you are thinking you should just pray for your helper to come lift you out of poverty. All I am saying is that hope is not a strategy. Some of the methods above rely on hope, luck, fantasy, and, quite frankly, delusion, while others are solid, legitimate means of making money.

You could become a successful actress, athlete, or artist. That’s very much possible. If you feel like that is your path and you are really good at it, go for it. Even if you do get famous, earning a lot of money is not the same thing as wealth. Crime and money rituals are definitely a no-go. You are risking your freedom and reputation for money? There are better ways. Don’t rely on luck or chances because there are practical methods that are likely to get you results more often than not.

In Lagos, you see a guy driving a Benz, Range Rover and think “that is wealth”. You want to buy that mansion in Lekki and let people know you have arrived after suffering so much. I get it. I’m not saying it’s not possible. But that is often just a display of money. The people you see with these fancy material things may or may not have wealth. Some of them are probably in debt, and some are not. There is no way for you to know, so I’d recommend that you not envy anybody. Real wealth is invisible. It is the quiet stock or business earning 20% while you sleep.

Money vs Wealth

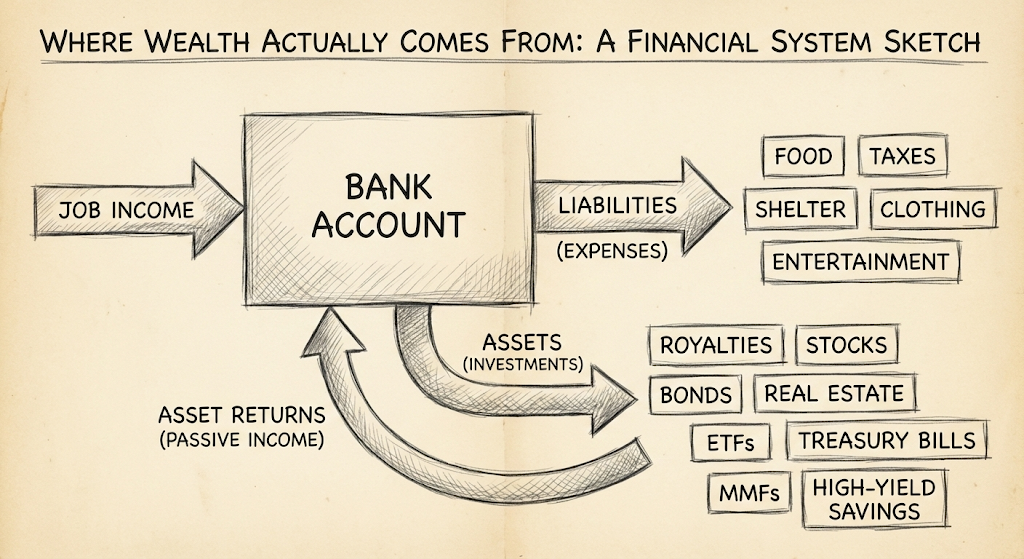

A lot of what we mistake for wealth is just money. Wealth could very well be the source of that money, but not in all cases, and that is a very important distinction. Before we explore where wealth truly comes from, let’s clarify where money itself comes from, because money is the foundation of wealth. Ultimately, it is what you do with that money that determines if you get wealthy.

Money comes from:

- Employment (a job)

- Monetizing fame: sponsorship deals, endorsement etc

- Contracting (freelancers, writers, artists, endorsements)

- Inheritance

- Media/skill/high leverage work (musicians, actresses, athletes, novelists)

- Business

- Investments

It’s one thing to earn money; it’s another thing to build wealth. Do not mistake the two. What you do with the money that you earn is what really matters. There’s a case to be made for high income and building a business that earns a lot of money, or even the money that comes with fame. A lot of money can be earned by striving for better jobs or renown. But once again, high-income ≠ wealth.

For example, take a famous person like Mike Tyson. At the height of his career, he earned around $400 million dollars from fights and endorsements. Do you know how insane that is? But guess what, in 2003, he declared himself broke. Can you imagine? No matter how much you earn, you can lose it all. He was not the only athlete or famous person this happened to. There are so many examples out there.

On the flip side, take musician, Yinka Ayefele, at the height of his fame, he probably earned hundreds of millions of Naira; we don’t know for sure. Just from what we know about him publicly, he owns several businesses: a radio station, real estate, a music studio, streaming, and of course, his live music performance business. That’s wealth. Here’s the thing though, if for whatever reason the whole world stopped listening to his existing music and he is physically unable to perform anywhere again, his businesses will always generate income for him even while he sleeps.

What People Do With Money

Let’s look at what people do with money. There are two possible things a person can do with money. You can either use it to buy:

- Liabilities or

- Assets

Liabilities are simply anything you can think of that you spend money on but does not earn you money. As you can guess, most of the things Nigerians spend money on are liabilities. Yes, food is a liability, buying a car is also a liability, if you don’t plan on starting an Uber/ transport business. Virtually anything you can think of that takes money out of your pocket but doesn’t earn money for you is a liability. Even all those flashy cars you see Lagos big boys & girls driving, or the fancy houses, the bling, private jets etc, are all liabilities. Examples of liabilities:

- Transport fare

- A personal car

- Rent

- The home where you live

- Food and groceries

- Designer clothes

- Eating out

- Uber/Bolt costs

- Aso Ebi

- Black tax

Assets are anything you buy with your money that can earn you money back. Popular examples of these in Naija are:

- buying/building a house to rent it out

- starting a business

- stocks

- treasury bills

- bonds

- Starting a podcast/YouTube channel that might potentially earn money

- a car for Uber

So an asset puts money in your pocket, while a liability takes money out.

Now, that does not mean all liabilities are bad. For instance, we all need food and shelter, and other living expenses. I’d say those are necessary liabilities. There is a lot of nuance to this subject. Some liabilities bring in intangible value, like buying asoebi for your best friend or sister’s wedding, which clearly is a liability that fosters social joy. The problem comes when it is not done with moderation. You can buy food, but once you start to eat out for almost every meal, it starts to add up really fast. Or you could spend on Aso Ebi for a close friend, but when you start to buy aso ebi for every Tom, dick, and Harry’s wedding then you have a problem.

Assets are a good thing because they bring in money for you as well. But it comes with a lot of nuance, too. For instance, you could think you are buying an asset, but end up buying a scam. Like getting duped buying real estate, buying “investments” that are actually scams or ponzi schemes (like MMM), investing in failed businesses, or buying a car for Uber that costs you more money in maintenance (fuel, repairs) than it brings in income, buying speculative assets, starting a business without proper due dilligence or starting one with a wrong partner.

Assets will make you wealthy, but you have to shine your eyes when buying any asset. Make sure you do your research. Whenever you see people rushing to buy an investment, don’t follow the crowd just like that; breathe and do your research first. You have to know what to look for. Due diligence is an entirely different post, but for the sake of brevity, if you are buying securities like stocks and bonds, make sure you are buying from reputable companies that are registered with the Securities and Exchange Commission (SEC).

Before you invest in something, understand how the money is made. Do not let anybody bamboozle you into buying an investment where you don’t even know how they make their money. If they are being secretive about how the money is made, run. If you have to bring someone in to make your own money, also run. If someone is promising you a return on investment that is too good to be true, please run. Thread really carefully when offered ROIs that are 25% and above in a short period of time.

Where Wealth Actually Comes From

To get wealthy, any money you get needs to go more into assets than liabilities. That’s it. As you continue to build up a portfolio of assets, ideally, you get wealthier, and one day you get to the point where your assets are enough to cover all your expenses without having to work a job.

Make enough money to buy more assets and let those assets preserve and grow your wealth.

There are Levels to This Money Thing

Now that you understand what money is and what wealth is, and the difference between assets and liabilities, let’s talk briefly about the journey. There are clear levels to this money thing, and no matter where you are right now, there is a practical path forward.

1. Under 18/students: You are young, no one expects you to bring in money; although you may have no responsibilities, you are not exempt from wealth building. Your goal at this stage in life is to learn as much as you can about money. Read investment books, even if you don’t have money to start investing yet, follow blogs like this one. Learn a useful skill. It does not have to be related to your university course; just make sure it is something you can enjoy learning. Start practicing how to save money, yes, even from the pocket money you are getting from your parents/guardian. If you have some extra time, get an after-school job that pays well without taking too much of your time. Fun fact, back in uni I worked at a printing shop for a stipend. You could also assist with project research, tutoring, sell note summaries, or provide services like printing, makeup, graphic design or hairdressing– any skill you are good at, to your peers for a stipend. The goal here is to learn how to be enterprising without letting it interfere with your school work, but only if you have the extra time.

2. No job or income: your problem here is that you don’t even have money to buy assets, even if you wanted to. Focus on building skills, and all your energy should be put into finding a job/starting your business. Shout it from the rooftop, post about your need of a job on LinkedIn, advertise your skills or products. Instead of doomscrolling on social media, post about the job you would like and your qualifications. Finding a job/income should be your full-time job. Brush up your resume, and highlight your skills to anyone who will listen. If you plan on starting a small business, gather capital from a job or get help from family and friends. Do not take a loan.

3. Low-paying job: You have a job, but you can’t even cover your living expenses. That means all of your salary is going into liabilities. In the worst case, you are taking on debt. Your utmost priority here is ruthlessly cutting all unnecessary liabilities, paying off your debt, and getting a better-paying job. You also need to learn DIY for cooking and other things you might be paying for, where possible. Focus on this with all your life’s force. Finally, learn a new skill that can land you better opportunities.

4. Average Paying Job/ Business: You have income that covers your living expenses, and with some money left to spend. On this level, you want to limit spending on liabilities as much as you can, save money, and strategically spend a huge chunk of that saved money on assets that bring you back money. You should also put energy into finding a better-paying job or starting a business/expanding an existing one. This is the prime spot for where you can start to learn about buying assets.

5. High Paying Job/Business: You have high income; this is not the time to start flexing on others or showing the world that you have arrived. You should still limit spending on liabilities. For instance, if you earn 3 million after taxes, and you want to build wealth, limit your liability spending to 25-30% (750,000 – 900,000) of your take-home at first. Extreme? I don’t think so. The rest of the 70% (2,250,000 Naira) should be going to buying assets that can bring you more money. The more money you make from your assets, the more your income grows, and eventually, your 30% spend on liabilities from your cash inflow will grow anyway. So it’s really more of a delayed gratification.

6. Financially Independent (FI): This is the point where your assets are bringing in enough money for you to live on without you having to lift a finger. You could decide to keep working, or you could stop working and retire. You could decide to travel the world or learn a new skill, or go into a new business or career entirely. You could go into music, acting, or whatever you damn well please. I, for example, as a hobby started this blog. My point is, this is the highest level of the hierarchy. The richest people in the world, think Elon Musk, Bill Gates, don’t really have to work ever again, but they only do it because they want to. At this stage, you can choose to put the money you earn from assets back into new or existing assets or just spend it. You don’t have to be stinking rich to be FI. The amount of money your assets need to generate to be FI depends on what you are comfortable with. It does not have to be billions of naira or millions of dollars, but it does have to be sustainable perpetually and indefinitely, all things being equal. We’ll explore this more in other posts.

So there are levels to this money thing, as you can see. Your goal should be to climb your way up from level 0 to 6. This blog will explore all of the ways to get to stage 6 in detail.

You want to drive a Range Rover/Benz, you want people to know you have arrived, buy that mansion in Lekki, it’s not impossible. I’m just saying that if you want flashy displays of money just for the sake of it, it’s probably because you have internalized what the media advertises as making it. What you really want is wealth and the freedom that comes with it. Money is just the means to that end. Don’t rely too much on hard work. Maids, construction workers work hard all their lives(not knocking them), but a lot of them never become wealthy. It’s not about working hard. Hard work helps you get money, but it is not the secret sauce for wealth; strategy is. So, do not rely on prayers, luck, or gambling to get it. Stop waiting for helpers or a rich spouse. You want to use techniques that don’t rely on luck. Something deterministic. No one is coming to save you; once you understand that, you can start taking action.

Yours Mindfully.

Adeyinka