One of the most important ways to build a successful budget is by prioritizing ruthlessly.

Cutting items from budgets is where people struggle. Most of us have a hard time letting go of high-dopamine, “fun” budget items in favor of the boring, essential, and high-leverage ones. When money is tight, it’s tempting to cut expenses randomly, but if you cut the wrong things, you risk financial instability, debt, or long-term stagnation.

The point of this post is to introduce a decision-making framework that helps you decide what to cut from your budget when money is tight. You will learn how to weigh one expense over another and in what order, so that you can put much less effort into wrestling with the decision and just take action.

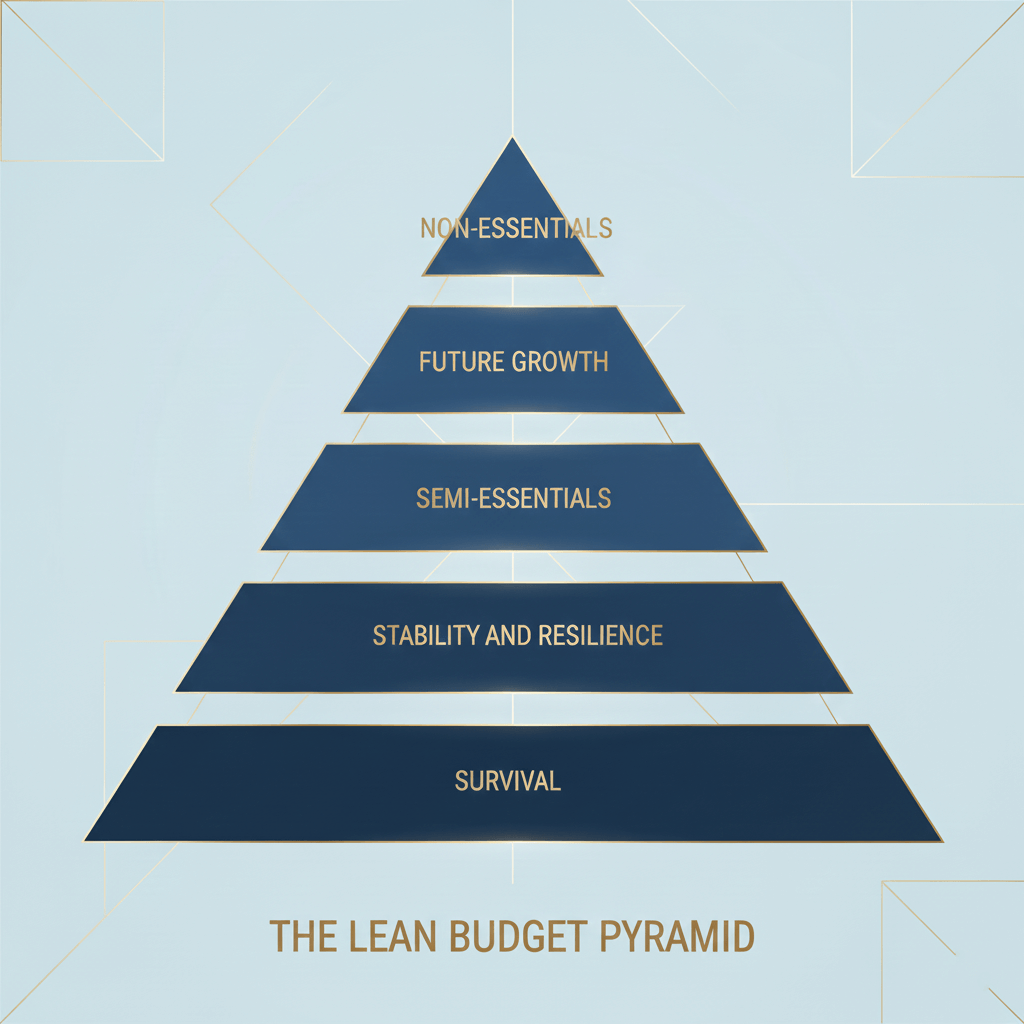

Presenting The Lean Budget Pyramid

Think of your budget as a pyramid, with each expense belonging to its respective tier.

When you prioritize cutting expenses, start cutting from the top of the pyramid and work your way down.

Tier 1: The Survival Layer

This is exactly what it sounds like: anything that allows us to continue being alive and maintain a tolerable level of comfort. These are the expenses that keep you housed, fed, safe, functional, and legally compliant. If it doesn’t help you earn or function, it’s not survival.

- Shelter: rent, service charge, basic home maintenance, or security fees.

- Basic food: staples like rice, beans, protein, grains, vegetables, cooking gas, or water.

- Utilities: electricity, water, data.

- Transportation: for work, market errands, or basic car maintenance.

- Health care, insurance, medication, basic checkups, or emergencies

- Debt: debt that carries severe penalties like high interest, threats, rent, or unemployment. Not all debt is survival. Only the debt that threatens your stability if unpaid qualifies.

- Basic call and data plan: for work, banking, transactions, emergencies.

- Legal costs: taxes, car paper renewals, or work certifications/renewals.

- Hygiene: basic soap, toothpaste, detergents, sanitary products, work-appropriate clothing, etc.

If your income stops tomorrow, these are the expenses you’d fight to keep funded first. Survival budget items are the most important items on a budget and should ideally never be cut. If you find yourself cutting them, something has gone terribly wrong. It’s a sign that your income pipeline needs more inflow, and you may want to put more energy into looking for better jobs or improving your business.

What Is Not Included?

Entertainment, junk food, subscriptions, comfort upgrades, new gadgets, fashion beyond basic function, eating out, and over-consumption of basics.

Tier 2: The Stability and Resilience Layer

Survival is about staying alive this month. Stability and resilience are about not panicking next month. It serves as both a psychological and literal buffer. It answers the question: if something goes wrong, do I have breathing room? This is money you don’t touch until emergencies, disruptions, or unforeseen essential expenses come up.

Core Components

Margin of Safety

This is your monthly pocket money, typically taken out of a monthly salary during budgeting. We discussed more on this in the main budgeting post. This is where you cover small monthly increases in food prices, transport, minor repairs, and small stresses. It gives your month breathing room and covers discretionary spending so you don’t have to dip into your savings.

Emergency fund

This is essentially a shock absorber for your personal finances. It covers job loss, medical emergencies, major repairs, income disruption, and slow business. Read more about emergency funds here.

Savings

This is your major stability fund. Some people call it their life savings. It’s the backup to your emergency fund. This is usually where funds are drawn for investments and other major projects.

These three components make up your stability and resilience layer. If you care about creating financial stability for yourself, make sure that you try as much as possible not to cut monthly contributions to this layer because it will save you when you’re in trouble.

It’s not about the amount, but about the habit. Even if it’s as low as ₦2000, it’s better than zero. It’s about becoming the kind of person who saves even when funds are tight.

This layer does not include spending for investments, long-term goals, lifestyle upgrades, vacations, or discretionary spending.

Tier 3: The Semi-Essentials Layer

These are the expenses that are not immediately necessary for your survival, but prevent future damage, stress, or loss of productivity. They are not urgent essentials. You may delay them temporarily sometimes, but ignoring them long enough may push them into the survival category.

When it comes time to cut expenses, you can cut them or delay them if your budget is too tight.

Let’s look at some examples:

- Home or living repairs: Plumbing work, small roof leaks, bad mattresses, faulty switches, and generator servicing.

- Work or productivity tools: Slow laptop upgrades, a good ergonomic chair replacement, or other work equipment.

- Transport: Engine oil changes, brake pad replacement, wheel alignment, and other car maintenance.

- Health: dental cleaning, gym memberships, or yearly checkups.

- Personal maintenance: Skincare, hairstyling beyond basic maintenance, clothing replacement, and comfortable shoes.

This category isn’t survival, but it’s not luxury either. It’s upkeep, maintenance, and more than the bare minimum.

What semi-essentials are not?

- Entertainment

- “I deserve this” purchases

- Status spending

- Luxury upgrades

- Vacations

Semi-essentials stop today’s stability from turning into tomorrow’s crisis. You can only cut from this fund in your budget if you have exhausted cutting from the non-essentials and the future growth fund.

Tier 4: The Future Growth Layer

Expenses that increase your ability to earn in the future. These expenses plant the seeds for higher income, leverage, options, or better opportunities.

Some examples:

- Education and Skills: Workshops, Courses, Training, Certifications, and Books.

- Business Growth and Entrepreneurship: Capital for New or Growing Business, professional tools, or work equipment.

- Investment and Wealth Building: Stocks, bonds, retirement contributions, and other investments.

- Low or Zero Interest Debt Repayments: Reducing debt increases your future financial capacity and peace of mind.

- Relocation: Traveling for better work opportunities, paying for relocation-based expenses.

Without this layer, you may survive and stay stable, but you won’t accelerate your wealth opportunities. While prioritizing your expenses, don’t cut expenses that belong to this fund before cutting non-essentials.

If things are still tight after cutting non-essentials, you may pause contributions till your budget can accommodate them again.

Tier 5: The Non-Essentials Layer

Non-essential expenses are at the top of the pyramid. This is the first category you cut when money is tight. These are the expenses that add enjoyment, comfort, or status to your life but are not required for your survival, stability, or future growth.

Examples are:

- eating out

- food delivery

- clubbing

- partying

- concerts

- vacations or weekend trips

- entertainment subscriptions

- fashion shopping

- gadgets for enjoyment, not utility

- aesthetic upgrades and luxury experiences.

Cut this from your budget when money is tight. Many people do this backwards. They prioritize enjoyment before they have saved or invested. They ball before they have secured growth. Non-Essentials are painful to cut because they are tied to status, emotion, pleasure, and short-term relief from stress.

At the top of the pyramid are the non-essentials. For example, eating out, clubbing, non-essential clothing shopping, vacations, and entertainment.

How Cutting Works

Now that you understand where your expenses potentially fit within the layers of the pyramid, the Lean Budget cutting is simple: start from non-essentials down to the bottom.

When money inflow is ideal, all tiers are funded: Non-essentials exist, future growth exists, all the tiers exist in your budget, and things are balanced.

But when money is tight, you automatically enter prioritization mode. Don’t cut every category on your budget evenly because it’s a priority list. Some tiers are more important than others. When money is tight, work your way down from the top of the pyramid and cut deeply from the top tiers before you cut the lower tiers.

Cut deep on the non-essentials first, pause or slow down contributions to the future growth and semi-essentials expenses. Don’t touch the survival, stability, and resilience fund expenses unless necessary.

Before you start saying, “I will borrow money from savings to keep non-essential expenses,” know that you are slowly eroding your ability to recover from emergencies in the future. If non-essentials are not empty, savings should not be touched. If future growth is still being funded, survival shouldn’t be touched or cut. This forces you to live within your monthly pay and not eat your future away, spending on things that won’t matter in 5 years before you’ve secured investments and future growth.

The Caveat: Categories are fluid. A semi-essential expense can suddenly become urgent if it is neglected or fails. For example, if you’ve noticed your front door knob being weak for a while, and you’ve been postponing fixing it. If one day the knob falls off, suddenly it becomes a survival expense because now your front door is unguarded and your safety is at stake.