You’re Not as Rational as You Think

When we make decisions, we always like to think that our decisions are rational and well-thought-through. But that couldn’t be further from the truth. The reality is that our mind takes mental shortcuts every single day.

These shortcuts allow us to make fast decisions for simple day-to-day situations. Without them, we’d be forced to carefully weigh every single choice we make, which would make normal life impossible.

It makes it easier for us to just live our lives and make fast decisions. These mental shortcuts take the form of gut feelings, the subconscious mind, and intuition.

You might have seen social media jokes where someone shares a sentence and then tells you, “You read that wrong.”

The Two Systems of Thinking

When we think, our brain makes use of two different styles: Fast and Slow.

Fast is for speedy decision-making, like when you see a simple problem like 2 + 2; but slow is for complex problems like 17 x 28. Psychologists call fast thinking System 1, and slow, effortful thinking System 2.

- System 1 is fast. It uses mental shortcuts and jumps to conclusions. It fills in blanks, relies on intuition, and doesn’t always think things through.

- System 2, on the other hand, is slow and deliberate. It requires focus and effort when you use it. It’s what you use when thinking about complex problems.

We use System 1 far more than we think, even when a situation actually requires System 2.

Quick Demo

Let’s test it.

Try to answer this as fast as you can:

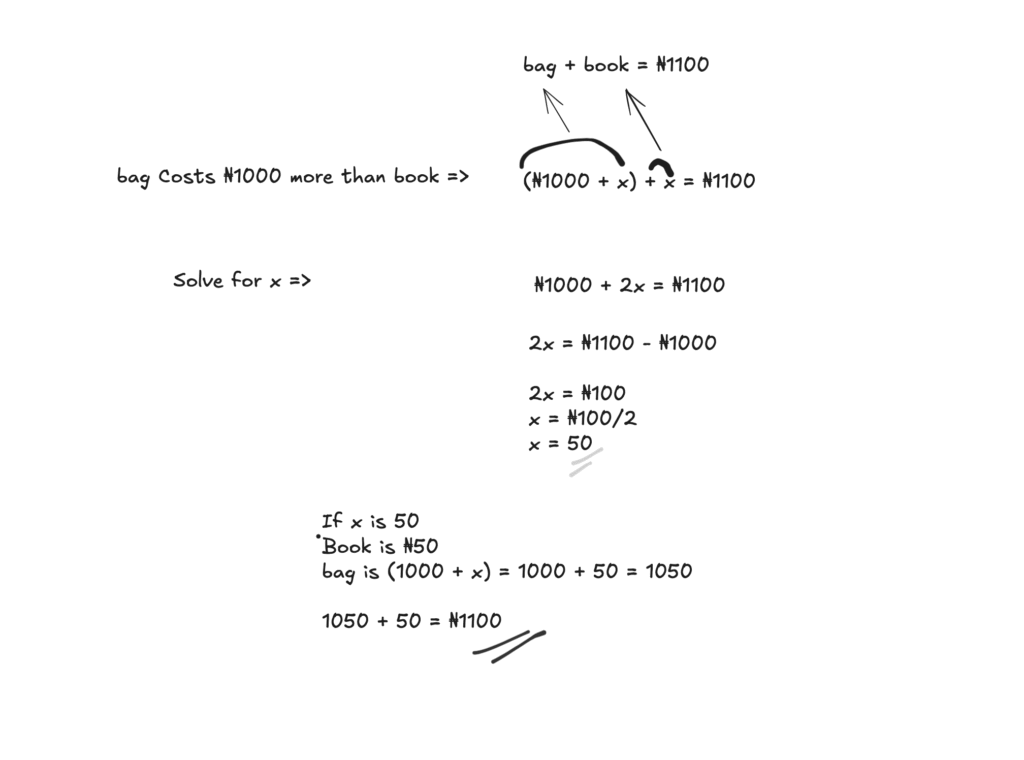

A bag and a book cost ₦1,100. The bag costs ₦1,000 more than the book. How much does the book cost?

The Automatic Answer: ₦100

The Correct Answer: ₦50

Your System 1 brain got it wrong. It jumped to the number that felt right instead of checking whether it actually worked.

If the book were ₦100, and the bag was ₦1,000 more than the book (₦1,100), the total would be ₦1,200.

If you were to use System 2 to solve this, you’d get:

Your brain uses automatic thinking in all areas of life. We make assumptions, we think we saw/heard something, but it was something else. We fall for the appearance of a situation, rather than its actual substance.

Why This Matters For Money

We like to think of ourselves as straight-thinking. Rational. Nobody’s fool. Especially when it comes to our finances. We tell ourselves we can’t be tricked, that we can spot marketing lies from a mile away.

But what if I told you that you can be tricked? Easily. Every day.

Businesses do it all the time. They’ve studied how these mental shortcuts to use them against us. They know how to make us buy what we never planned to buy and spend more than we intended.

They do this by targeting the part of our brain that psychologists call automatic thinking, or System 1, as we discussed. Businesses design their websites, advertisements, copywriting, marketing, sales, and entire user experience to appeal to that error-prone, fast System 1 thinking. They use it to sell to us, shape assumptions about their products, and influence us to buy more.

Error-Prone Decisions

Mental shortcuts are necessary for us to get through our daily lives, no doubt. Without it, we’d be stuck ruminating on simple decisions, like recognizing a friend’s face, deciding whether water tastes funny, or even tying our shoes.

But as we’ve seen in the demo above, mental shortcuts are prone to error. When it comes to the most sensitive areas of our lives, such as our personal finances, we must be aware of where our decision-making is vulnerable to thinking errors.

Mental shortcuts can lead to biases, and biases lead to poor money decisions, such as:

- falling for marketing tricks

- trends that don’t benefit us

- advertisements

- not being able to identify scams

- investing in the wrong business.

It is important that anyone who cares about their financial future be aware that mental shortcuts and biases exist so that they can arm themselves when they need to make money decisions from sales, negotiations, advertisements to investments, and business.

Your Brain Can Be Hacked

The idea that our decisions are not always rational might be scary at first or even shocking, but once you start to see it, you can’t unsee it.

The best defense is to learn which biases you are prone to.

In other posts, we dive deep into specific biases like:

- Anchoring: Why the first number you see changes your perception of value.

- Availability: Why we overrate things that are easy to remember.

- Authority: Why we follow “experts” even when they are wrong.

- Reciprocation: Why “free” gifts often make you spend more money.

These are all biases that can be used to nudge us towards choices we didn’t plan to make.

Can you think of a time when you made a mistake due to a mental shortcut? Let us know in the comments below.

Key Takeaways

- System 1 is fast and intuitive but makes mistakes.

- System 2 is slow and logical but requires effort.

- Marketing targets System 1 to make you spend impulsively.

- Awareness is your best financial defense.